Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. If you are using.

When Do Nris Need To File Income Tax Return In India Nri Saving And Investment Tips Income Tax Income Tax Return Investing

These 14 tax tutorials will guide you through the basics of tax preparation giving you the background you need to electronically file your tax return.

. Ad Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online. 1 day agoPass-through entities use a tax form called Schedule K-1 to report a partners or shareholders share of the profits losses and other income of a partnership or S corporation. Get Your Tax Forms Make sure you have the forms you need to file your taxes including Form W-2 from your employer and your previous tax transcripts.

Federal payroll tax rates for 2022 are. During this time new income tax administrators learn the skills and. 1800 103 0025 or 1800 419 0025.

You are a senior that is not married and make less than 14250. In Step 6 of your income tax and benefit return you use two amounts to determine the final result of your tax return. The current tax expense is the amount of income tax a company will pay for the current year.

At the end of the year every person that earned income must file a. Income tax and benefit return Income tax and benefit return. Clear Up-to-Date Program Teaches All You Need to Know.

The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendozas office said in a. Calculate your gross income. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

Income tax payable is a term given to a business organizations tax liability to the government where it operates. Investing can be an important tool in growing wealth. Get Certified in 8 Weeks.

From Simple to Advanced Income Taxes. Get Certified in 8 Weeks. 2021 tax preparation software.

Ad A Proven Method of Teaching Successful Tax Preparers Since 1952. Based On Circumstances You May Already Qualify For Tax Relief. The amount of liability will be based on its profitability during a.

Get Certified in 8 Weeks. Tax filing done on an IRS partner site Some state tax preparation and filing are free Choose an IRS Free File Offer Fillable Forms Available for any income level Free. What Age Can You Stop Filing Income Taxes.

100 Free Tax Filing. Efile your tax return directly to the IRS. Dont Know How To Start Filing Your Taxes.

The higher your tax bracket the higher your tax-equivalent yield. Ad See If You Qualify For IRS Fresh Start Program. Prepare federal and state income taxes online.

You can file manually by completing Form 1040 according to instructions provided by. For starters check out the tax. Ad Stand Up To The IRS.

A W-2 form from each employer Other earning and interest statements 1099 and 1099-INT forms Receipts for. Ad E-file your taxes directly to the IRS. How To File a Tax Return You have three options when it comes to filing your taxes.

Free Case Review Begin Online. The rates have gone up over time though the rate has been largely unchanged since 1992. Income tax administrators spend an average of 1-3 months on post-employment on-the-job training.

This will include all the components of your salary including House Rent Allowance HRA Leave Travel. One notable exception is if the 15th falls on a. Clear Up-to-Date Program Teaches All You Need to Know.

Personal income tax Ways to do your taxes You have several ways to do your taxes including options that are free or have varying costs or others where you are invited by the CRA. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year.

Ad A Proven Method of Teaching Successful Tax Preparers Since 1952. Shoot for Long-Term Capital Gains. Quickly Prepare and File Your 2021 Tax Return.

Steps to File a Tax Return Gather your paperwork including. The collection of income taxes occurs throughout the year by withholding money from a persons paychecks. It is calculated from current earnings and the current years permanent.

Connect With An Expert For Unlimited Advice. Social Security tax rate. How to File Your Federal Taxes.

First write down your annual gross salary you get. Get Certified in 8 Weeks. You are a senior.

You can stop filing income taxes at age 65 if.

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

Benefits Of Income Tax Return Filing Before Due Date Itr Filing Rules Income Tax Return Income Tax Income Tax Return Filing

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Tax Checklist

Income Exempted Tax Deductions List Money Financial Taxact

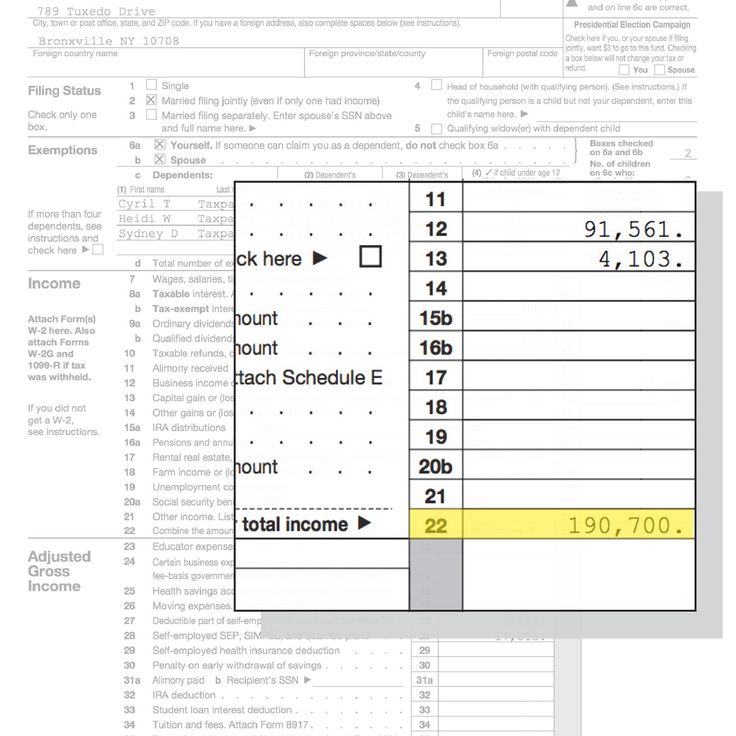

Form 1040 U S Individual Income Tax Return 2015 Mbcvirtual In 2022 Income Tax Return Income Tax Tax Return

Income Tax Rules 9 Form 9g Ten Precautions You Must Take Before Attending Income Tax Rules 9 Tax Rules Income Tax Income

I Received A Form 1099 Nec What Should I Do Federal Income Tax Business Income

When Do Nris Need To File Income Tax Return In India Nri Saving And Investment Tips Income Tax Return Income Tax Investment Tips

Here Is A Worksheet On Taxes We Live In California So I Used The Taxes That Apply To Us I Also Used A Minimum Amount Of Income Tax Income Tax

Common Federal Income Tax Forms In The U S Business And Individual Tax Forms Irs Tax Forms Irs Taxes

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Income Income Tax Return Paying Taxes

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Tax Return Income Tax Taxact

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

A Beginner S Guide To Taxes Do I Have To File A Tax Return Tax Return Beginners Guide Married Filing Separately

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Income Tax Form 12 Download 12 12 Pdf Seven Things You Should Know About Income Tax Form 12 Income Tax Tax Forms Income Tax Return

Form 8 Agi 8 Ten Quick Tips Regarding Form 8 Agi 8 Tax Forms Income Tax Irs Tax Forms